What You Don’t Say Can Hurt You

When Verizon replaced its CEO, it left a crucial question hanging. The news media jumped in

Corporate communicators often face twin challenges — anticipating questions from the news media and then prying answers out of closed-mouth leaders.

When Verizon Communications this month replaced its long-time CEO “effective immediately,” the communications team surely knew the tough questions that would follow.

But getting those answers into the Oct. 6, 2025, announcement was another matter. While the nation’s largest mobile phone service provider was largely silent, reporters and stock analysts were there to tell Verizon’s story.

Investors too seized on four words in the 700-word press release which implied that Verizon is launching a price war, a battle that would cut into profits of not just Verizon but also its major competitors.

That wasn’t what the stock market wanted to hear. On the day of the announcement, Verizon’s stock fell 5%, AT&T’s fell 4% and T-Mobile US’s fell 2%. Is that what Verizon, mired in a nearly five-year stock slump, intended?

In a report, Peter Supino, a senior analyst with investment firm Wolfe Research, summed up the situation this way: “CEO transition at last…but the script could have been better.”

We don’t know what efforts the comms and investor relations team made to provide answers to the questions they knew were coming. We also don’t know why Verizon’s board of directors and new CEO didn’t outline clearly the new strategy, so we can’t say the decision was wrong.

But we can say that when a company leaves a key question unanswered about an important decision, others will rush in to provide answers. We’ll take a close look at the announcement.

The announcement

The board of directors announced that “effective immediately” it had dismissed Hans Vestberg, its CEO since 2018 and chairman for nearly as long. Just the third CEO since 2002, he’s credited with leading the company’s expansion into faster, 5G service.

Vestberg was vulnerable because Verizon’s stock has steadily fallen since December 2020, when it topped $61. On the day of the announcement, the stock fell to $40.74 per share and hasn’t recovered.

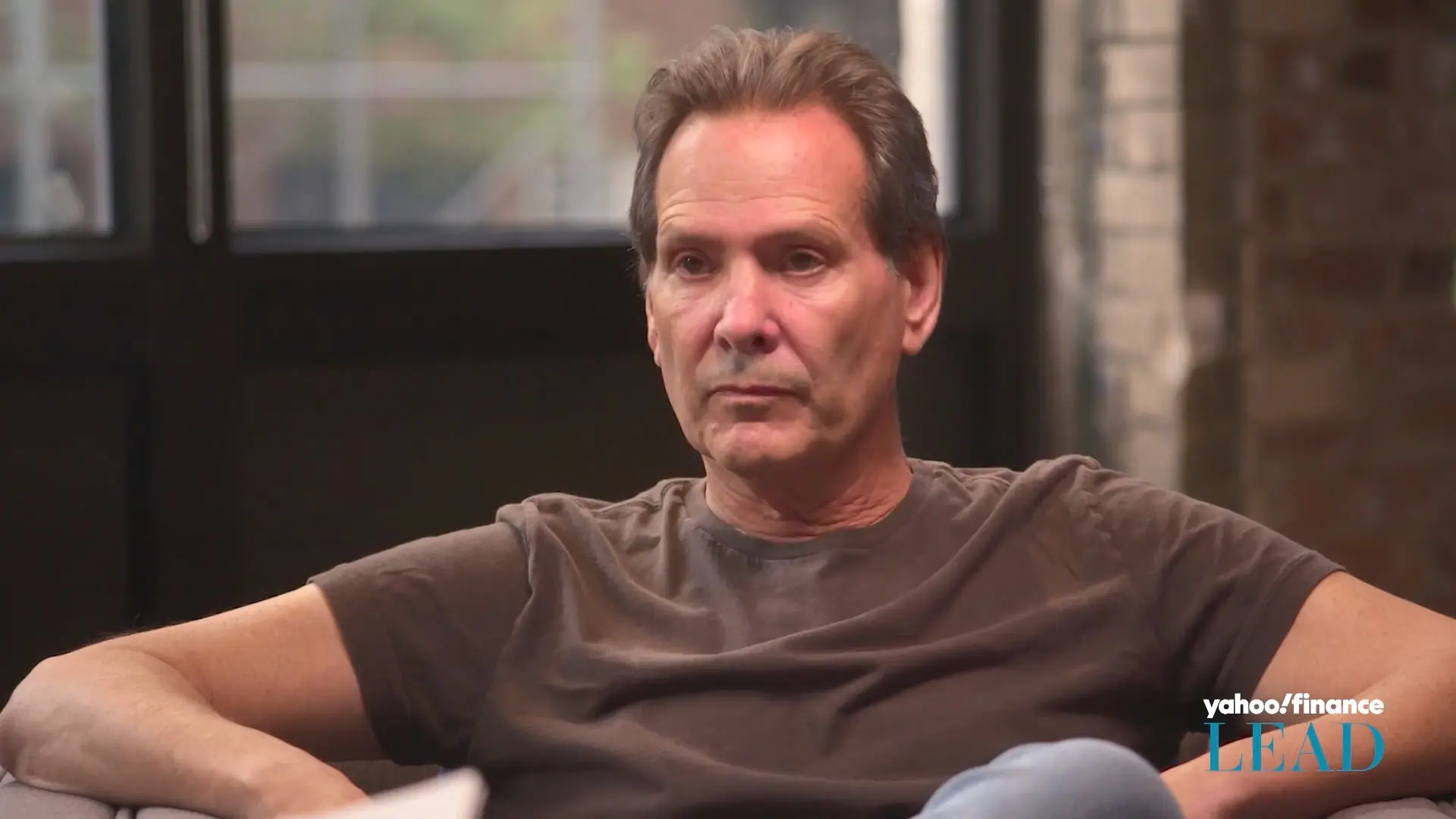

Vestberg, 60, was replaced as CEO by Dan Schulman, 67, a director since 2018 and former CEO of PayPal Holdings, where he had a strong record for boosting revenue during an eight-year run.

He began his career at AT&T, where he rose through the ranks to become president of the Consumer Markets Division before leaving in 1999. He was the founding CEO of Virgin Mobile USA from 2001 through its sale in 2009.

Vestberg was replaced as chairman by Mark Bertolini, a director since 2015 and former CEO of health-insurer Aetna. Vestberg will stay with the company for a year as a member of the board and an advisor, concentrating on the integration of a high-speed internet company acquired in a $20 billion deal.

The company didn’t hold a conference call with analysts to introduce its new chief executive. While such calls are a way to provide information, the questions posed are also a valuable source of information about what outsiders think.

Verizon will get the chance to present its new chief executive when it discusses its third quarter financial results on Oct. 29, rescheduled from Oct. 21.

While Verizon didn’t answer the questions raised by suddenly replacing its CEO, it did reaffirm its previous guidance about profitability.

The reaction

Without direction from Verizon, analysts and investors pounced on this sentence from a quote by Schulman (I’ve highlighted the key words): “We have a clear opportunity to redefine our trajectory, by growing our market share across all segments of the market, while delivering meaningful growth in our key financial metrics.”

“How Verizon frightened wireless investors with these four words,” was the headline of a story by Emily Bary of MarketWatch and the theme of the day.

Verizon could start “more aggressively luring new customers — and retaining existing ones — with things like device promotions and ‘free’ add-on services,” Bary wrote. “But those would hit the company’s profit margins, and likely send rivals scrambling to make aggressive offers of their own.”

Sam McHugh, head of telecom equity research at BNP Paribas, wrote in a note to clients, “The market is clearly worried about Verizon becoming more aggressive again in wireless to defend share.”

His comment was picked up by Barron’s.

Maybe this is the strategy, and Schulman is prepared to take hits to the stock price until market share improves. Or maybe it’s not, and Verizon has shot itself in the stock-price foot.

Verizon’s strategy was the biggest question left unanswered, but not the only one. Here are three more:

1. Why so suddenly? “The lack of a clear ‘why’ and ‘why now’ rationale for the change leaves too much blank space for speculation and second-guessing,” IDC analyst Jason Leigh told communications news site Fierce Network.

In contrast, rival T-Mobile announced a more orderly transition on Sept. 22. Its current CEO is moving on Nov. 1 to a new position of vice-chairman, focused on strategy, while continuing as a board member. He will be replaced by the chief operating officer.

2. A short-term CEO? “At age 67, Schulman is not a long-term solution,” Bloomberg columnist Beth Kowitt wrote.

3. Why not Sampath? Many on Wall Street assumed that Sowmyanarayan Sampath, the head of Verizon’s consumer group, would be the next CEO, Fierce Network reported. Will he now look for a new job?

Hello and good-bye

After being named CEO, Schulman posted a written message to Verizon employees on LinkedIn, offering a little info about his career and repeating his message that the company will “regain our leadership by growing share across all segments of the market.”

Vestberg posted a video in which he was upbeat yet wistful.

“This is an extraordinary emotional time for me,” he said.

“It’s never the right time to step down,” he added, “but for me it’s the right time right now.”

It would have been a better time for Verizon if it hadn’t left so many questions hanging.

Tom Corfman is a senior consultant with Ragan Consulting Group who’s now going to be looking for a mobile phone deal. He directs the Build Better Writers program, which features one-on-one editing and coaching. Want to learn more about the program? Email Tom.

Follow RCG on LinkedIn and subscribe to our weekly newsletter here.